By Bob Cunneen, Senior Economist, MLC Asset Management

The “painful squeeze” for Australian consumers

Australians are experiencing tough times. Every trip to the supermarket leaves us leaner and poorer in terms of our purchasing power. The $20 note barely covers a bottle of milk, a loaf of bread and a carton of eggs.

When you arrive home, you are afraid to switch on the heater and lights given the costs. For many, the cheaper and safer choice is to crawl into bed early, pull the blanket over and then try to dream of better days ahead.

High inflation is clearly a global problem. Australia’s current annual inflation at 6.8% in the year to April 2023 sits midway between Europe at 8.1% and the US at 4.9%. Yet Australia’s inflation has local consequences. The consumer has become very cautious in spending because our budgets are stretched to breaking point. This has implications for Australia’s economy, house and share prices as well as our health and wellbeing.

Our central bank, the Reserve Bank of Australia (RBA), seems aware of these challenges. The RBA Governor noted in June when raising the cash interest rate to 4.1% that the “combination of higher interest rates and cost-of-living pressures is leading to a substantial slowing in household spending … some households have substantial savings buffers, although others are experiencing a painful squeeze on their finances.”

However, the question needs to be asked: Is the RBA mindful of how dramatic this “painful squeeze” really is? Some fortunate few may have “savings buffers”, but the “others” are many and rapidly growing in numbers.

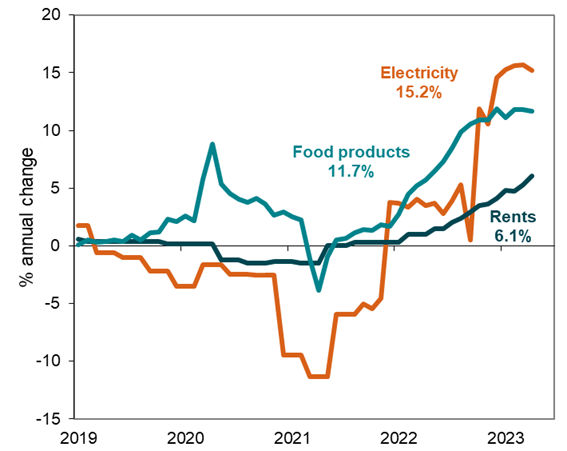

Everything is going up except our confidence

The most recent April Consumer Price Index (CPI) displays these painful price pressures (Chart 1). In the year to April, electricity prices have risen by 15.2%, food products by 11.7% and rents by 6.1% according to the Australian Bureau of Statistics (ABS)[1]. Yet this data does not fully reflect the reality on the ground. Given the delays in capturing new rentals which are rising at a +10% annual pace according to CoreLogic, the reality is that renters are being hit hard. Notably 31% of Australian households are renters – so this rental squeeze impact is hardly just “some” households.[2]

Chart 1: Australia’s painful price pressures

Source: ABS.

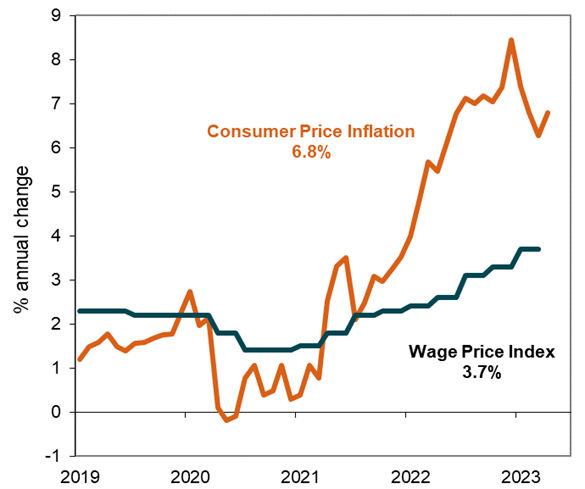

The ‘painful squeeze’ is also evidenced by the wide gap between Australia’s CPI inflation rate at 6.8% and wages growth running at 3.7% in the year to March (Chart 2). Effectively worker’s wages have failed to keep pace with inflation. This ‘inflation – wages gap’ has been the reality for the past two years. The toil of work has provided little compensation for the reality of higher consumer prices. Admittedly a 5.75% increase in award wages was announced on 2 June, which applies for the coming financial year[3]. However, this award wage rise only directly benefits ‘some’ 20% of the workforce. Even so, rising wages have not fully compensated for the recent inflation experience. Hence the ‘wage slave’ status still applies for all too many.

Chart 2: Australia’s inflation rate vs wages growth

Source: ABS.

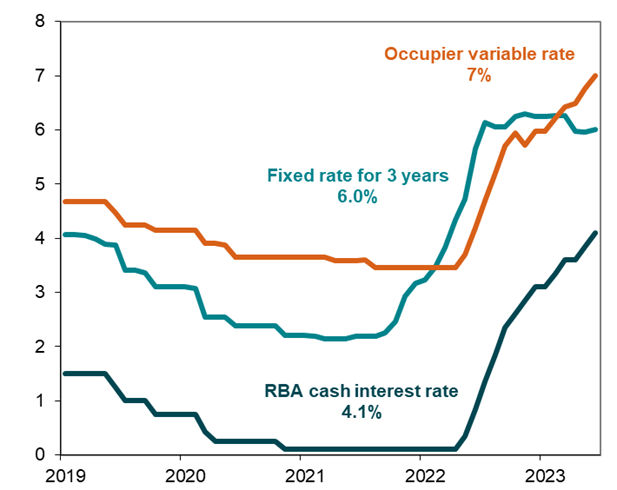

The RBA continues to turn the vice by pushing interest rates higher

The RBA is just one of many central banks such as the US and European central banks to aggressively raise cash interest rates to curb inflation. The RBA’s cash interest rate has risen from 0.1% to 4.1% in the past year. Hence another price being paid for higher inflation is rising housing interest rates. The direct impact is that Australia’s variable mortgage rate has more than doubled from 2.9% to circa 7% for ‘owner occupiers’ (Chart 3). Similar pain has been felt by investors with housing loans.

For now, ‘some’ fortunate fixed rate borrowers who borrowed at the available 2% interest rate back around 2021 have been insulated from rising interest rates. However, these fixed loans are approaching their ‘use by date’, so these borrowers face a ‘sticker shock’ of moving either to a 6% fixed or 7% variable rate. Effectively this is known as the ‘mortgage cliff’ as fixed rate borrower’s budgets plunge into an abyss.

Chart 3: Australia’s cash interest rate vs home loan rates

Source: RBA.

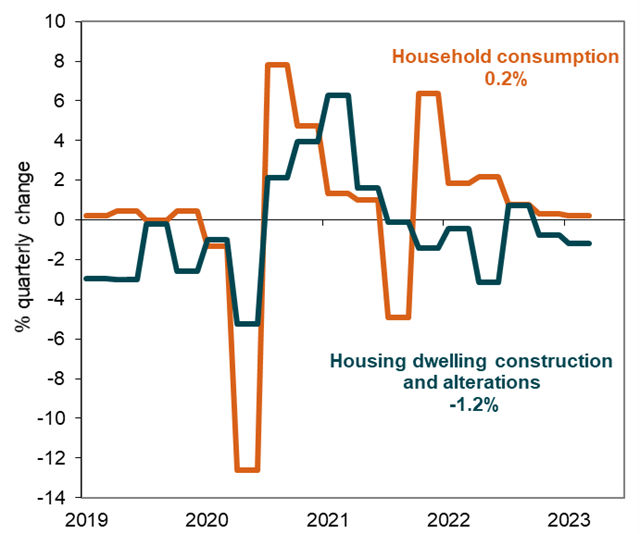

This ‘painful squeeze’ of higher interest rates is exacting a toll on consumer spending and housing construction. The most recent National Accounts showed that household consumption spending barely increased by only 0.2% in the March quarter while housing construction and alterations fell by -1.2% (Chart 4)[4]. Consumers are reducing demand for goods and services as well as housing because of the squeeze on purchasing power. The savings rate for households has fallen to 3.7%, the lowest since June 2008. There is also angst to come with further price rises. The proposed +20% lift in electricity prices in the new financial year will further challenge our budgets on whether to keep the lights on and the heater going.

Chart 4: Australia’s GDP spending components

Source: ABS.

For the broader Australian economy, this challenging mix of high inflation and rising interest rates on the consumer suggests that the Australian economy will struggle over the next year.

Are there any hopeful signs?

There is some good news even amidst these difficult times. Firstly, the jobs market remains remarkably strong with solid jobs growth and high vacancies. This suggests that some workers have the bargaining power to negotiate higher wages, more working hours or even both. The spectre of underemployment - where part-time workers could not get sufficient hours – is essentially at a 15 year low of 6.1%. Unemployment at 3.7% is also at multi-decade lows.[5]

Secondly, the Federal Government’s Budget is on a path to record its first surplus in 15 years. While this may be a temporary windfall given the strong jobs market and commodity prices, this does give the Federal Government more scope to alleviate the pain of high inflation and interest rates. More government support measures for low-income households are clearly needed as noted by the Australian Council of Social Service.[6]

Finally, our financial challenges can be made more tolerable by focusing on family and friends rather than the ebbs and outflows of our bank accounts. Our dinners may feature more of the cheaper cuts of meat and vegetables as well as the occasional wine – but this can be more than made up for by spending more time on conversations rather than crying into your pretzels[7].

[1] Monthly Consumer Price Index Indicator, April 2023 | Australian Bureau of Statistics (abs.gov.au).

[2] Housing Occupancy and Costs, May 2022, Australian Bureau of Statistics (abs.gov.au).

[3] Australia's minimum wage jumps by 8.6 per cent, award workers get 5.75 per cent pay boost, Hutchens, G & Chalmers, S, ABC News, 2 June 2023.

[4] Australian National Accounts: National Income, Expenditure and Product, March 2023 | Australian Bureau of Statistics (abs.gov.au).

[5] Labour Force Australia, April 2023, Australian Bureau of Statistics (abs.gov.au).

[6] ‘Governments must do more to provide relief to people on low incomes struggling with the cost of energy bills’. Australian Council of Social Service, Media release, May 25, 2023.

[7] “Soggy Pretzels” lyrics, Neil Diamond, Hot August Night album, 1972.

Important information

This communication is provided by MLC Investments Limited (ABN 30 002 641 661, AFSL 230705) (MLC), part of the Insignia Financial Group of companies (comprising Insignia Financial Ltd, ABN 49 100 103 722 and its related bodies corporate) (‘Insignia Financial Group’). An investment with MLC does not represent a deposit or liability of, and is not guaranteed by, the Insignia Financial Group.

This information may constitute general advice. It has been prepared without taking account of an investor's objectives, financial situation or needs and because of that an investor should, before acting on the advice, consider the appropriateness of the advice having regard to their personal objectives, financial situation and needs.

Past performance is not a reliable indicator of future performance. Share market returns are all in local currency.

Any opinions expressed in this communication constitute our judgement at the time of issue and are subject to change. We believe that the information contained in this communication is correct and that any estimates, opinions, conclusions, or recommendations are reasonably held or made as at the time of compilation. However, no warranty is made as to their accuracy or reliability (which may change without notice), or other information contained in this communication.

This information is directed to and prepared for Australian residents only.

MLC may use the services of any member of the Insignia Financial Group where it makes good business sense to do so and will benefit customers. Amounts paid for these services are always negotiated on an arm's length basis. MLC relies on third parties to provide certain information and is not responsible for its accuracy, nor is MLC liable for any loss arising from a person relying on information provided by third parties.

Bloomberg Finance L.P. and its affiliates (collectively, “Bloomberg”) do not approve or endorse any information included in this material and disclaim all liability for any loss or damage of any kind arising out of the use of all or any part of this material.

The funds referred to herein is not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to any such funds.