Getting to know investments

What is an asset class?

Asset classes are different investment categories and are the building blocks of an investment. The main asset classes are shares, property, fixed interest and cash.

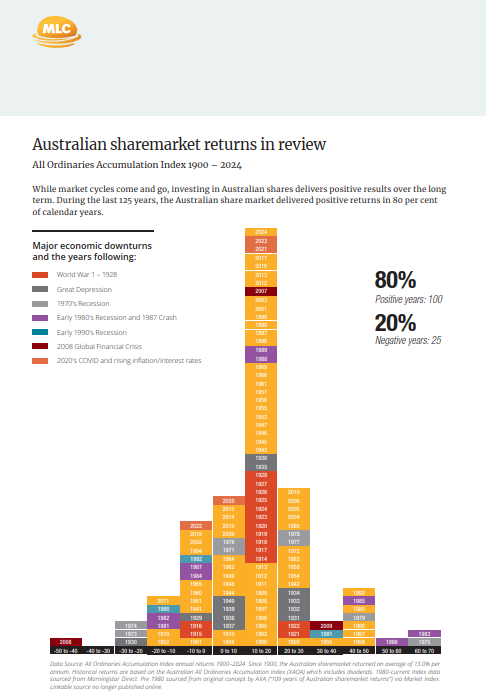

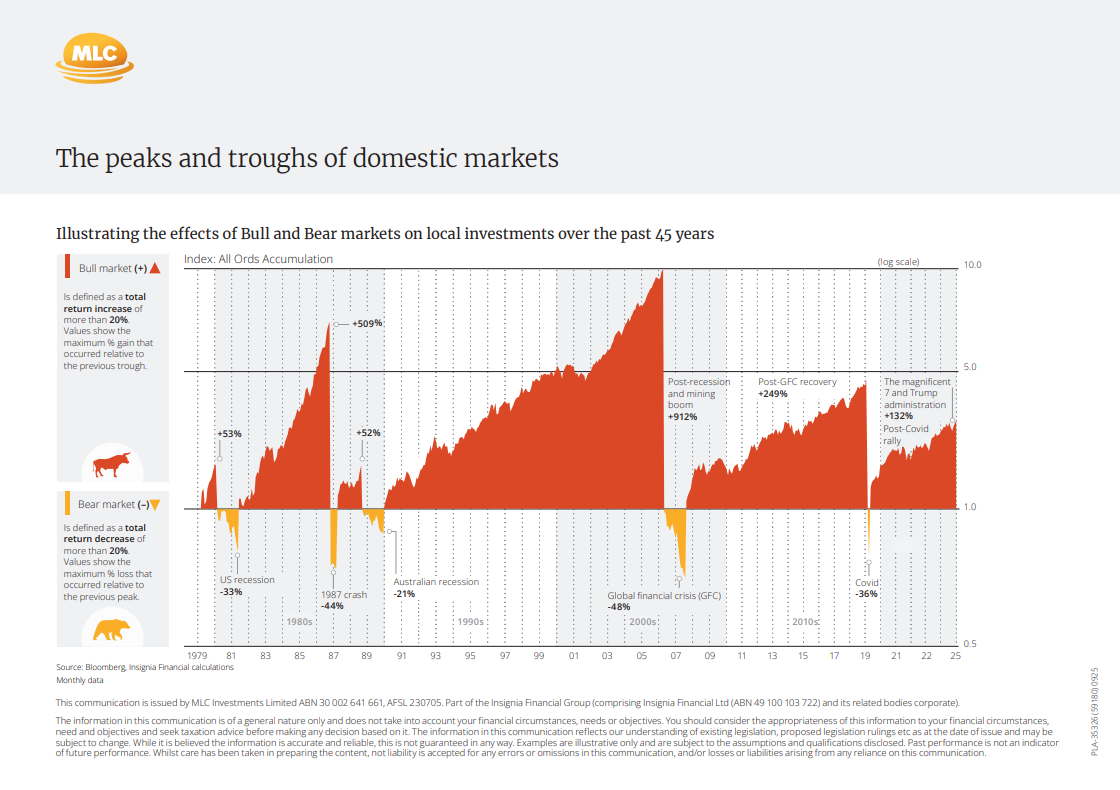

Australian Shares

Australian shares are shares in companies listed on Australian stock exchanges. Shares or stocks are securities representing ownership in a company. When companies distribute profits (via dividends), the investor receives part of it and often Australian companies partially or fully pay the tax payable on company income (franking).

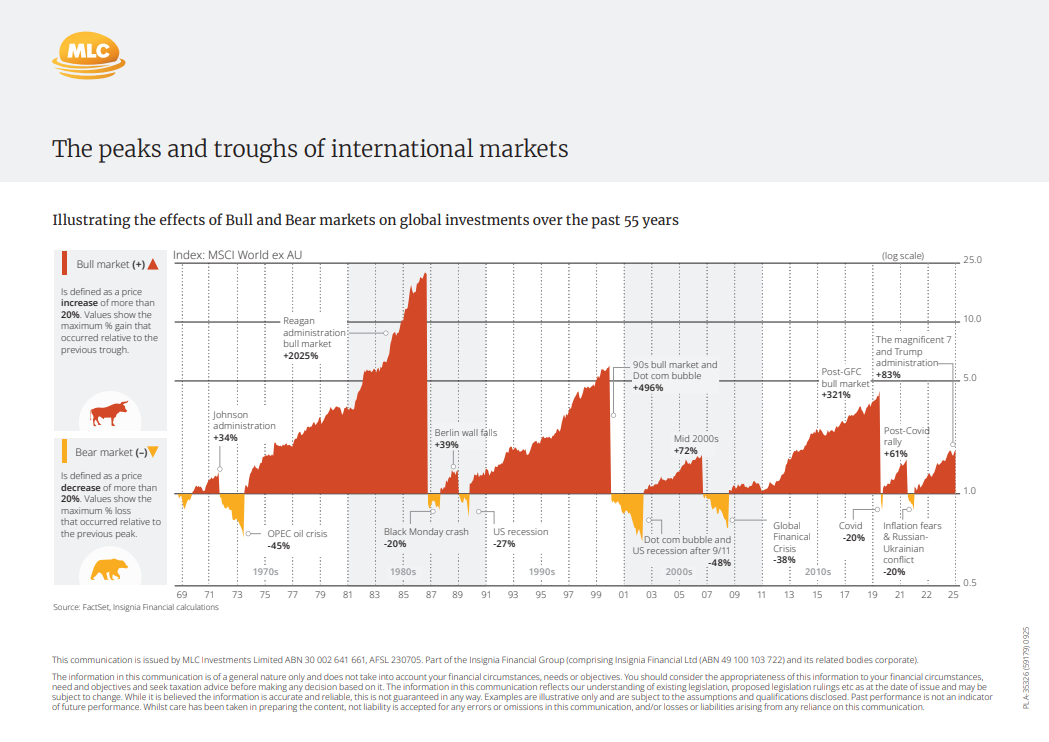

Global shares

Global shares are shares listed on international stock exchanges. Global shares can have the additional risk of movements in the value of the Australian dollar against foreign currencies. Changes in exchange rates will change the Australian dollar value of Global shares. Fund managers can use strategies called derivatives to ‘manage’ investments against adverse currency movements.

Listed Real Assets (Property)

Property can include investments in listed property trusts (LPT) and other property securities. LPTs invest in a range of residential and commercial property, office buildings, hotels and industrial properties. LPTs are pooled property investments which are broken into units and listed on the stock exchange like shares in a company.

Fixed Interest

A fixed interest investment is a debt security issued by a bank, corporation or government in return for cash from an investor. The issuer of the debt is effectively a borrower and is required to pay interest on the loan for the life of the security. Fixed interest investments are valued on a mark to market basis, and as a result, their value may fluctuate. Fixed interest investments are generally higher risk than cash but lower risk than shares and property.

Cash

Cash funds are designed to offer a high degree of capital security relative to other asset classes. Generally, cash investments have a very low risk of capital loss. Examples include bank deposits and investments in fixed interest securities, including treasury notes and highly rated corporate debt securities which generally have a maturity of less than one year.

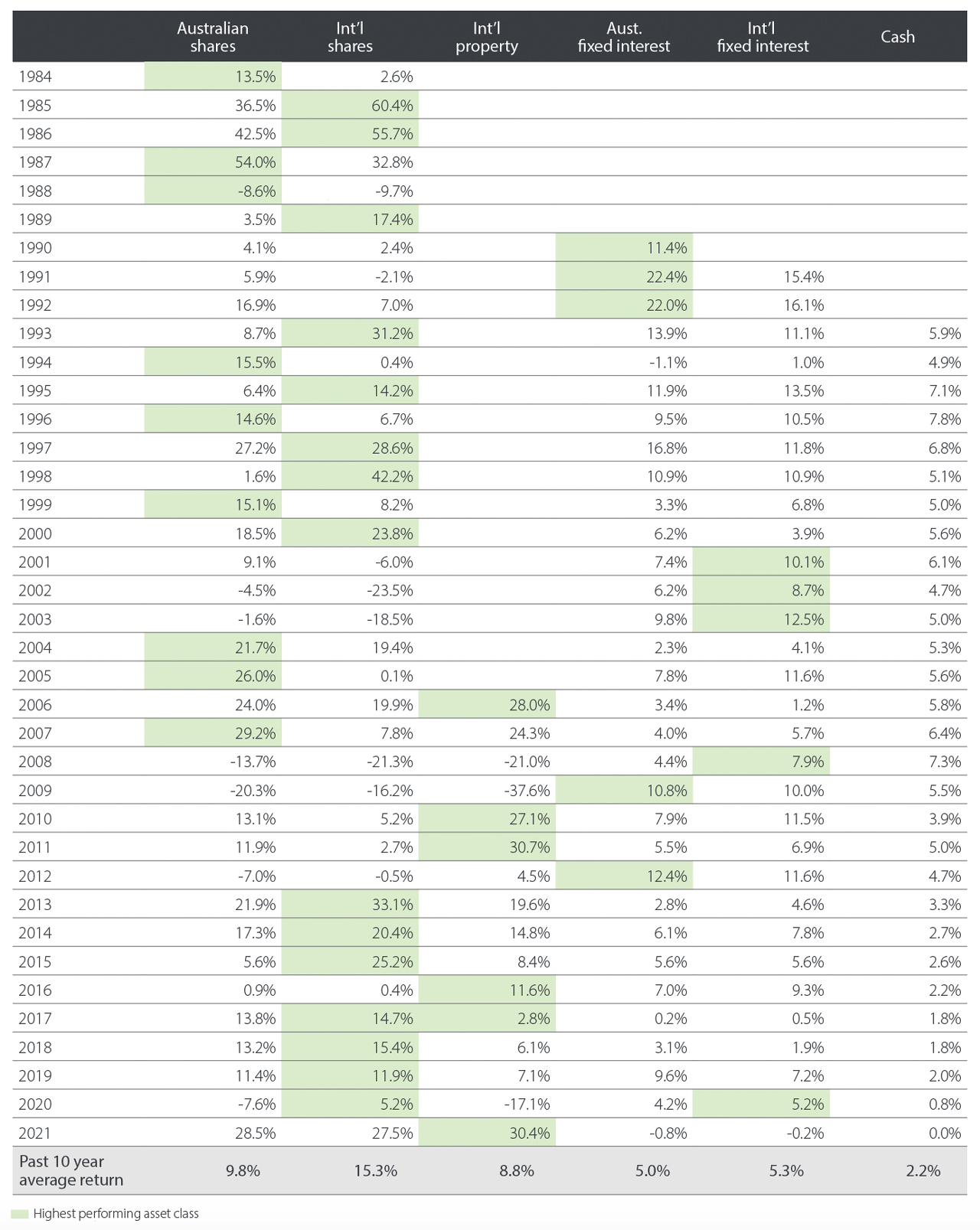

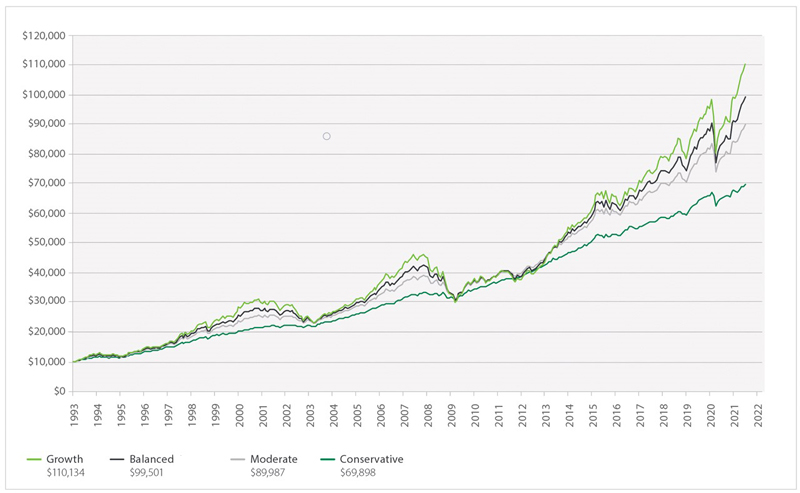

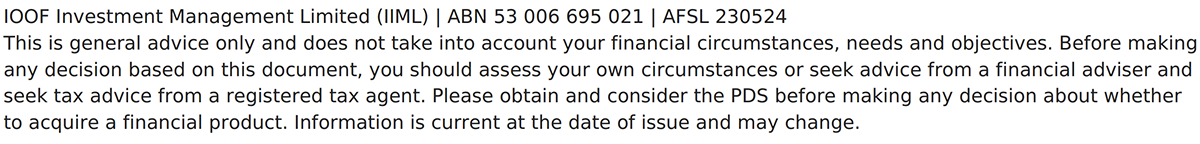

Key asset class performance^

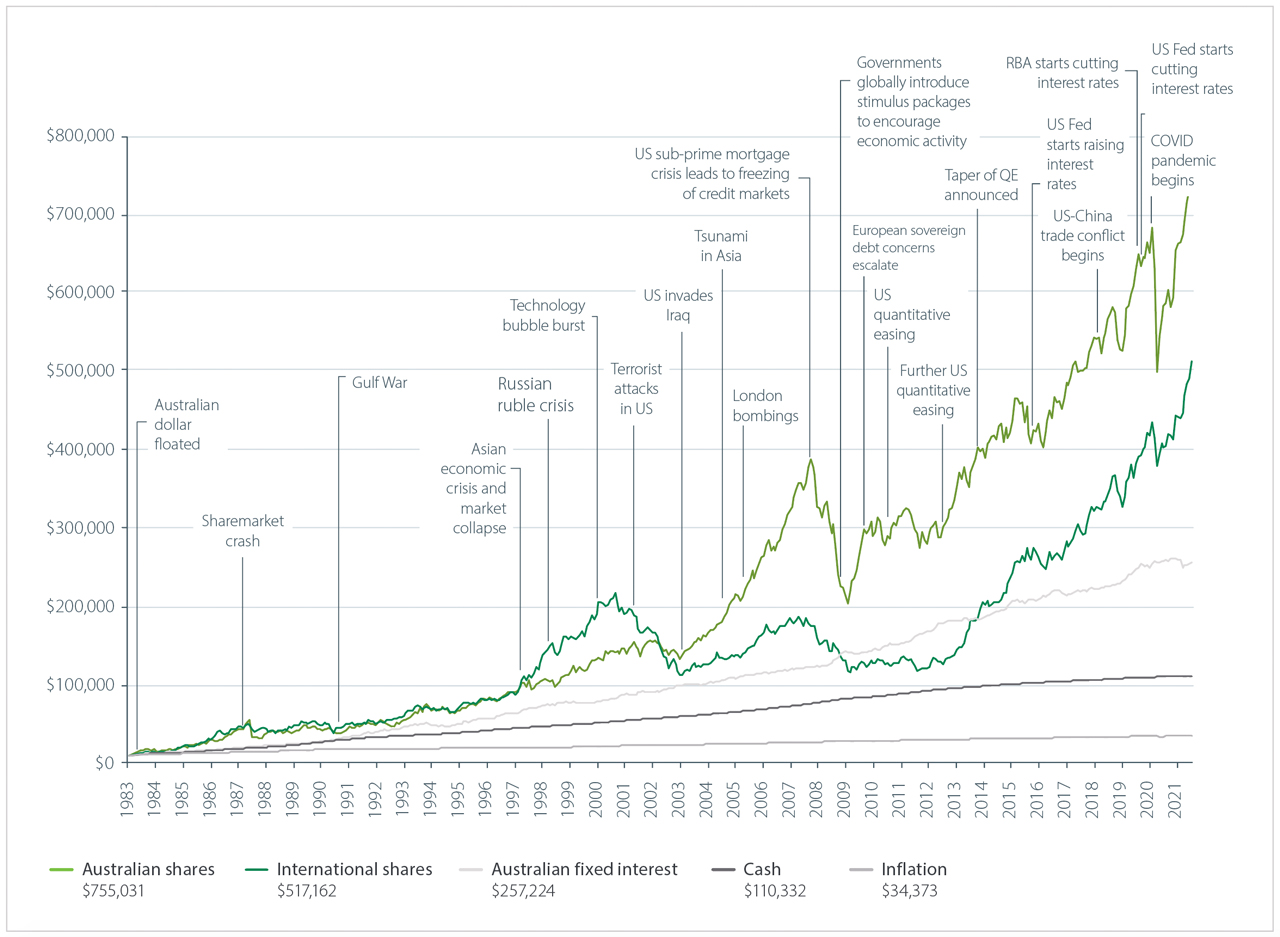

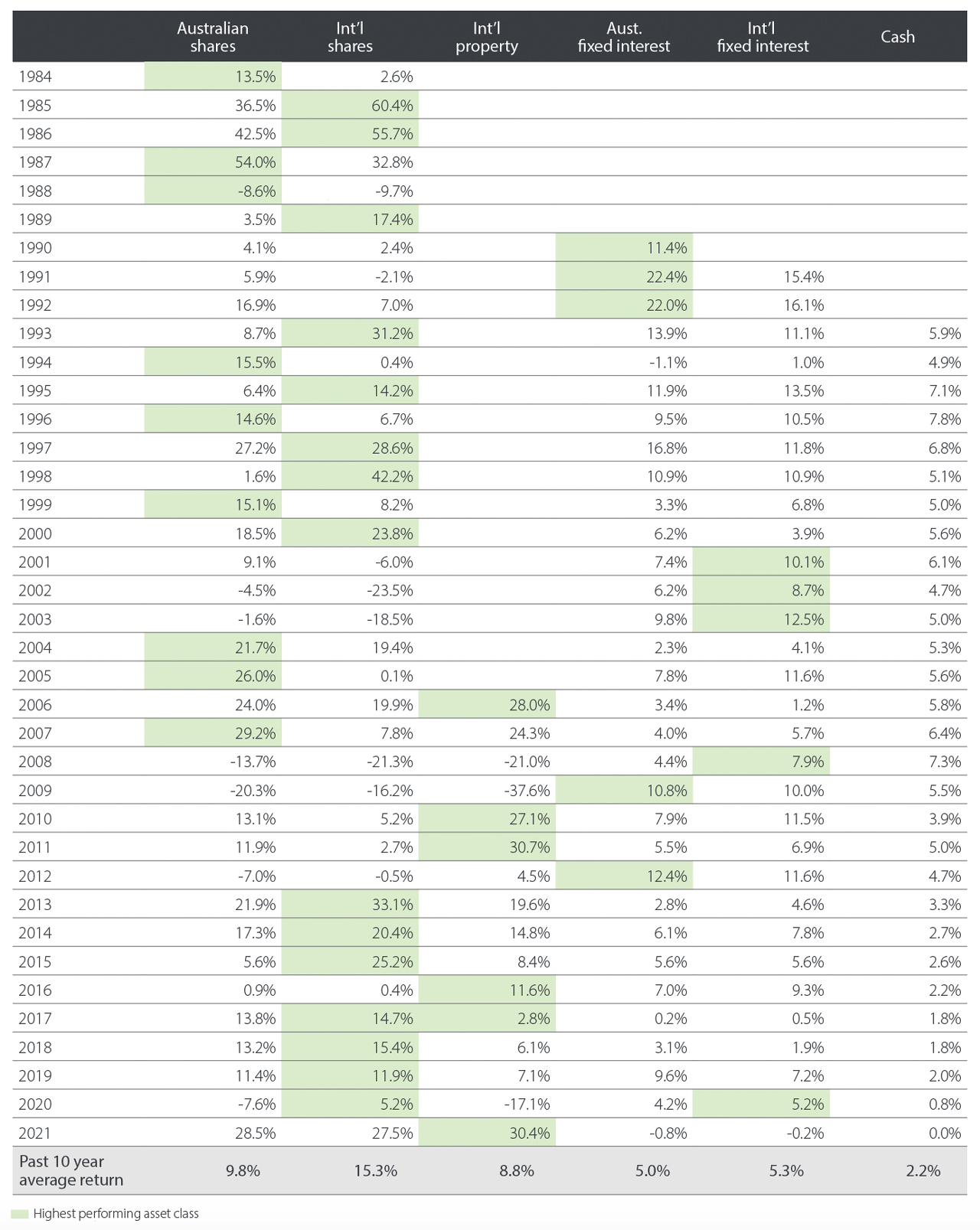

Growth of $10,000 invested over time#

^Timeframe: 1 July 1983 to 30 June 2021.

#Timeframe: 1 January 1983 to 30 June 2021. Past performance is not indicative of future performance. Your investment is subject to investment risk, including possible repayment delays and loss of income and capital invested. Any case study is shown for illustrative purposes only and is not a prediction of the actual outcomes you will achieve. Listed real assets and international fixed interest are not included in the graph above because data is not available from 1983.

Source: FactSet.

Data: Australian shares: S&P/ASX 300 Total Return Index | Global shares: MSCI World (ex Aust) Net Total Return Index in AUD | International listed property trusts: FTSE EPRA NAREIT (ex Aust) Total Return Index hedged to AUD | Australian fixed interest: Bloomberg AusBond Composite 0+ Years | International fixed interest: Bloomberg Barclays Global Aggregate hedged in AUD | Cash: Bloomberg Ausbond Bank Bill Index | Inflation: Consumer Price Index.

Note: Alternative assets do not have a standardised index so have not been included in the table or graph.

Important Information: This document is issued by IOOF Investment Services Ltd (IISL) ABN 80 007 350 405, AFSL 230703. IISL is a company within the IOOF Group which consists of IOOF Holdings Ltd ABN 49 100 103 722 and its related bodies corporate. This document contains factual information only and should not be relied on for decision making. This information in this document is based in part on information obtained in good faith from third party sources and is current as at September 2021. While this information is believed to be accurate and reliable at the time of publication, to the extent permitted by law, no liability is accepted for any loss or damage as a result of reliance upon it.